Beyond H2Q-Amania: Why the Rise of the Rest Bodes Well for the Midwest

By: Builder Online

Perhaps, no two four-letter words matter more to people whose livelihoods revolve around building homes for other people to live in and prosper.

Which two four-letter words come to mind? [It’s forgiveness Friday, so there are no wrong answers.]

Jobs is one. Dirt is the other.

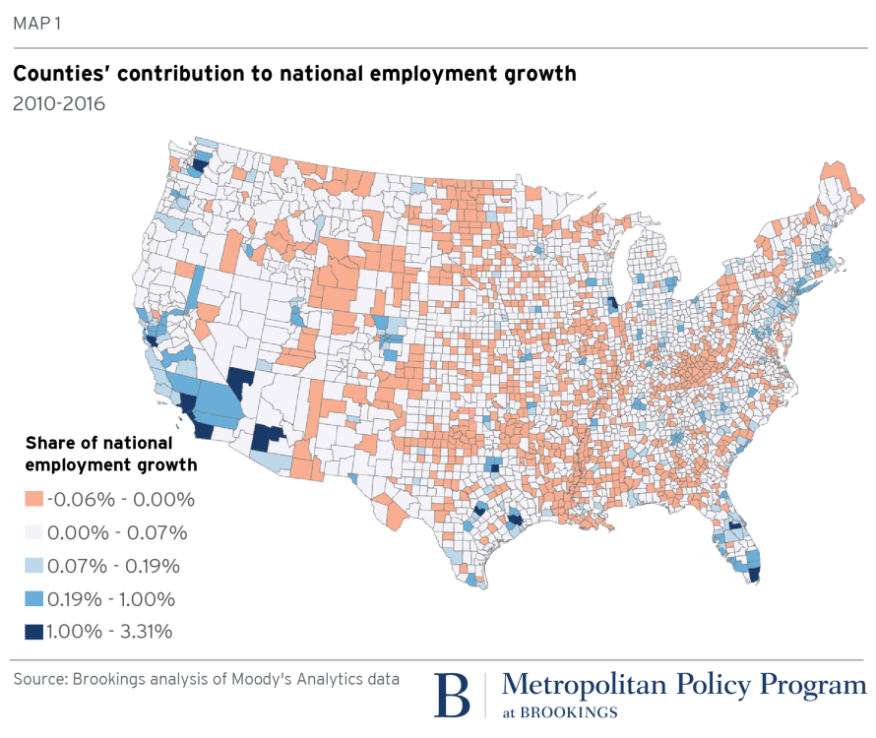

Now here, from Brookings Institution Metropolitan Policy Program fellow John C. Austin, is an analysis that has a fresh sweep of insight into one of those terms—Jobs—which, in turn, has powerful implications for residential planners, developers, investors, and builders on the other of the two four-letter subjects: Dirt.

Austin’s analysis, “The nation’s freshwater coast is a key fulcrum for Rust Belt revival,” explores the geography of economic renewal. A lynchpin that goes far to explaining why many of the heartland’s metro areas have been able to turn on their heels toward a 21st Century renaissance?

Public-private partnerships. By no means a novel concept, but one that’s critical to how both healthy and re-emergent geographical and market areas can develop a regenerative, sustaining way forward. Austin writes:

An urbanizing, technology-driven services economy has replaced the belching factories of yesteryear. Many factories, plants, and port facilities on the water became redundant, leaving behind a riot of detritus from the industrial era, including 31 toxic national areas of concern in the water.

Facing this cycle of change, many communities in the region initiated public-private partnerships to clean up the mess from the industrial era, reconnect downtowns to formerly industrial riverfronts and lakefronts, and create new amenity options.

Austin’s analysis, and that of others, point to potentially important shifts in land-position strategies for Sun Belt-oriented builders and developers who may want to take a contrarian approach to lot pipeline management over the next decade. Too, this would be consequential to the types of communities, home “building envelope” structures and specifications, and pricing models that builders would need to become highly proficient in in order to avail of the emerging opportunities.

New Geography sage Joel Kotkin and his associate, demographer Michael Shires make note in a Forbes piece on white collar jobs growth that aligns with Brookings fellow Austin’s premise. Although a Sun Belt “surge” takes first place in their spotlight of fast-growing white collar jobs centers, their analysis zeroes in too on “midwestern surprises:”

Some Midwestern cities are doing much better. Perhaps the biggest surprise on our list is No. 3 Kansas City, which has seen 25.3% growth since 2012 and a healthy 4.6% last year. The Missouri city (whose Amazon proposal was worked on by Joel Kotkin and Richard Florida) has been attracting a lot of corporate expansions, with employment in corporate and enterprise management growing by 57% since 2010, according to analyst Mark Schill. Among the companies adding jobs in the area have been stalwarts in tech (Garmin and Cerner), logistics (CVS, Amazon, Jet.com), manufacturing (GM, Ford, Honeywell, Kubota); headquarters expansions include firms such as Auto Alert, Littler Mendelson, and In Touch Solutions.

Kansas City’s appeal somewhat mirrors that of Sun Belt metropolises in that it offers inexpensive housing and office space. Kansas City has a low cost of living (93.7, where 100.0 is average), according to the latest (2015) Bureau of Economic Analysis Regional Price Parities. It’s the 11th least expensive out of the 53 major U.S. metropolitan areas. It also has some things most Sun Belt cities lack — for one, a large, historic downtown — and is among the easiest American cities to get around. Kansas City tied with Indianapolis for the least all-day traffic congestion among the approximately 175 metropolitan areas in the world with populations over 1 million that are rated by the Tom Tom Traffic Index.

Similar strengths can be seen in some other Midwestern cities such as No. 15 Indianapolis and No. 24 Louisville. Indianapolis’ business and professional services has grown 20.7% since 2012 while Louisville’s expanded 16.4%. All three of these cities enjoyed above average population growth and net in-migration last year.

Jobs that follow the footsteps of investment and tech start-ups in their pre-breakthrough early stages are where the better dirt opportunities are for builders, where demand is still low and buyer leverage is stronger.

Local entrepreneurs and big investors are scouting the Midwest for start-up investments that range up to tens of millions of dollars, far more than local angel and venture investors. And they are beginning to attract venture capital from Silicon Valley for follow-on rounds of funding.

The rationale for investing in the Midwest combines cost and opportunity. A top-flight software engineer who is paid $100,000 a year in the Midwest might well command $200,000 or more in the Bay Area. The Midwest, the optimists say, also has ample tech talent, with excellent engineers coming out of major state and private universities in the region.

But they also point to technology shifts. As technology transforms nontech industries like health care, agriculture, transportation, finance and manufacturing, the Midwest investors argue that being close to customers will be more important than being close to the wellspring of technology.

While Amazon and its vaunted, hyper-hyped, reality-contest-show type of process of elimination to select a site for its second headquarters plays out in the media, the “dirt” in many midwestern metros gets more valuable by the day.